Background

As mentioned in our previous post, the Japanese Consumption Tax (JCT) will be going through major changes in 2023.

The key points regarding these changes are:

- Japanese tax authorities will be introducing the JCT Qualified Invoice System in 2023

- Only Qualified Invoices can be deducted when your customer files a consumption tax return

- Only Qualified Invoice Issuers can issue qualified invoices

- In order to become a qualified invoice issuer, you need to register as such with the tax authorities by March 31, 2023

In this post we will cover the requirements regarding the Qualified Invoice.

- Is there a mandatory format?

- What information needs to be on the Qualified Invoice?

- What will a Qualified Invoice actually look like?

Let’s find out!

Is there a mandatory JCT Qualified Invoice format?

The short answer is no, there is no mandatory format that is required by law or other regulations. (Source: Question 25 of the “Q&A on the storage method of eligible invoices etc. under the system for deductible input tax on consumption tax”)

As long as the document includes the “necessary information”, it will be considered a Qualified Invoice, regardless of the name of the document.

For example, such documents are often referred to as the following in practice:

- Invoices

- Delivery Slips

- Receipts

What information needs to be on the Qualified Invoice?

The following information needs to be displayed on a Qualified Invoice

- The name and registration number of the issuer of the qualified invoice

- The date of transfer or other disposition of the taxable asset (*)

- The content of the asset or service related to the transfer or other disposition of the taxable asset (if the transfer or other disposition of the taxable asset is a transfer or other disposition of reduced-rate asset, the content of the asset and the fact that it is a transfer or other disposition of reduced-rate asset)

- The total of the tax-excluded or tax-inclusive amount of the taxable asset for each tax rate, and the applicable tax rate

- The consumption tax amount, etc., for each tax rate

- The name of recipient of the invoice

* If a qualified invoice is prepared for multiple transfers or other dispositions of taxable assets made during a certain period within the same tax period, that period can be used instead of a single date.

What if my invoice is denominated in a foreign currency?

The yen amount of “the consumption tax amount, etc., for each tax rate” will need to be displayed on such invoices.

The other amounts may be in foreign currencies.

(Source: Question 59 of the “Q&A on the storage method of eligible invoices etc. under the system for deductible input tax on consumption tax”)

There are several ways to do the calculation:

- Calculate consumption tax etc. after converting the total of the tax-excluded amount of the taxable asset for each tax rate (foreign currency tax-excluded) into yen.

- Calculate consumption tax etc. after converting the total of the tax-inclusive amount of the taxable asset for each tax rate (foreign currency tax-excluded) into yen.

- Calculate consumption tax etc. in the foreign currency using the total of the tax-excluded amount of the taxable asset for each tax rate (foreign currency tax-excluded), then converting that into yen.

- Calculate consumption tax etc. in the foreign currency using the total of the tax-inclusive amount of the taxable asset for each tax rate (foreign currency tax-excluded), then converting that into yen.

The foreign currency conversion should be done in a way that is in accordance with income tax law and corporate tax law.

However, when such calculations are difficult when issuing the invoice, other reasonable methods may be used, with the condition that they are applied continuously.

Such methods may include using the exchange rate on the invoice issuance date or settlement date.

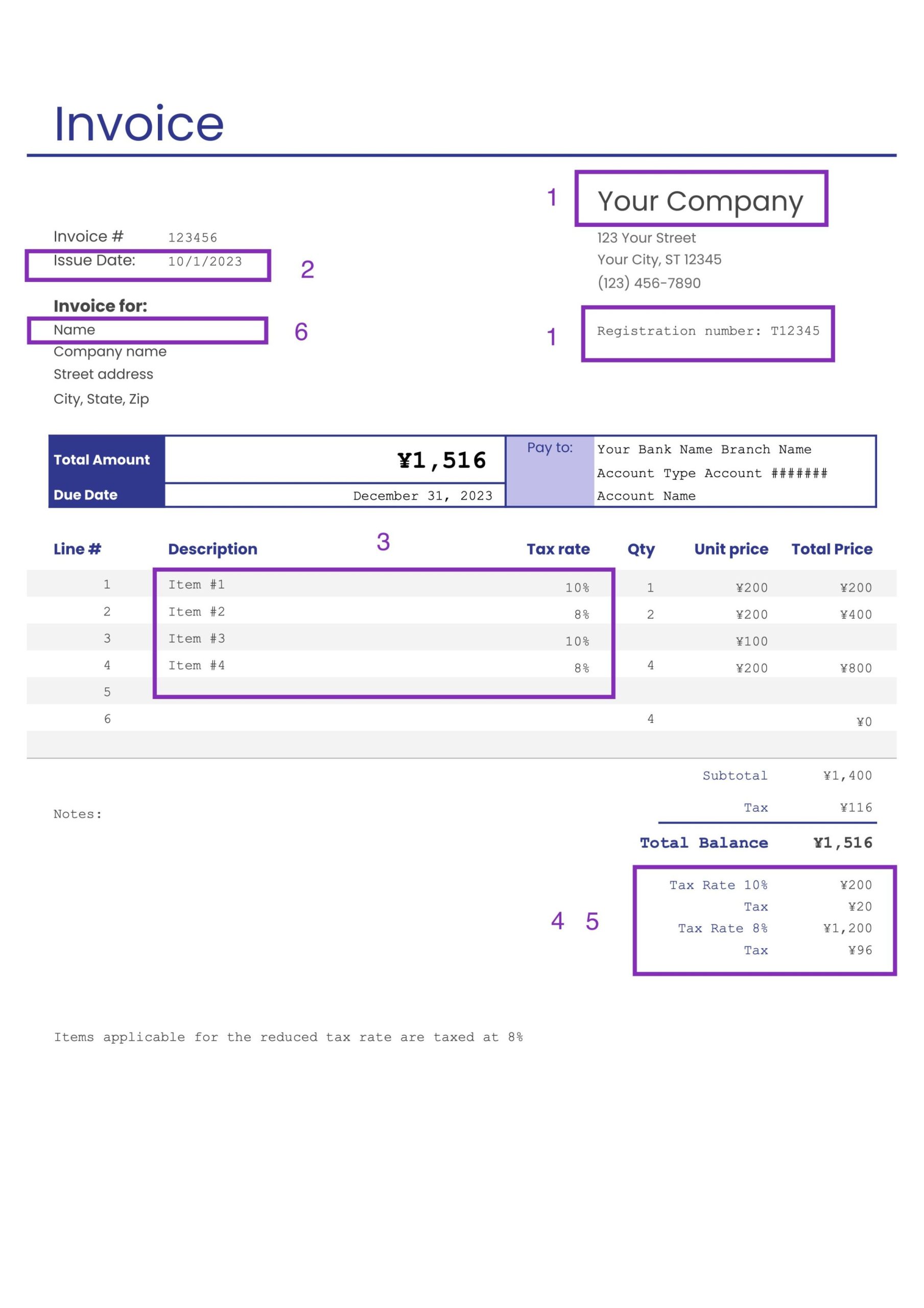

What will a Qualified Invoice Actually Look Like?

An actual qualified invoice could look something like this (prepared by the author).

You can find the template at the following link which will take you to Google Sheets.

Create a copy of the file on your Google Drive and off you go!

We have a Japanese version of the Qualified Invoice in there too.

(Updated January 17, 2023) Added dollar denominated version (English)

(Updated February 1, 2023) Added bitcoin denominated version (English)

JCT Qualified Invoice Sample Template (Google Sheets)

Who is exempt from issuing Qualified Invoices?

Depending on the nature of the business a Qualified Invoice Issuer is in, it may not be realistic to issue a Qualified Invoice for all transactions.

There are several transaction types that are exempt from issuing Qualified Invoices for each transaction. (Source: Question 1 of the “Q&A on the storage method of eligible invoices etc. under the system for deductible input tax on consumption tax”)

Here they are:

- Transportation of passengers by public transportation (ships, buses, or trains) that cost less than 30,000 yen.

- Sale of fresh food and other items by sellers at wholesale markets (limited to sales carried out by commission agents on behalf of sellers).

- Sale of agricultural, forestry, and marine products by producers, entrusted to agricultural cooperatives, fishery cooperatives, or forestry cooperatives (limited unconditional entrustment methods and joint accounting methods that do not specifically identify producers).

- Sales of goods and other items through vending machines and automatic service machines that cost less than 30,000 yen.

- Postal and cargo services where the only form of payment is stamps and related items (limited to items placed in postal boxes).

Note: For businesses that transact with a large number of unspecified people, such as retail, food and beverage, and taxi businesses, the use of a Simplified Qualified Invoice is permitted.

What is a Simplified Qualified Invoice?

A Simplified Qualified Invoice is literally a simplified version of a Qualified Invoice.

It’s really not all that different though…

The difference between a Qualified Invoice and a Simplified Qualified Invoice is the following:

- A Simplified Qualified Invoice may omit the the name of recipient of the invoice

- On a Simplified Qualified Invoice, the issuer may choose to display either the consumption tax amount, etc., for each tax rate or the applicable tax rate

Who can use a Simplified Qualified Invoice?

Qualified Invoice issuers in the following businesses (businesses that transact with an unspecified and numerous number of people) may issue a Simplified Qualified Invoice. (Source: Question 24 of the “Q&A on the storage method of eligible invoices etc. under the system for deductible input tax on consumption tax”)

- Retail business

- Food and beverage industry

- Photography business

- Travel industry

- Taxi business

- Parking business (limited to those for unspecified and numerous individuals)

- Other businesses that are similar to these and that transact with unspecified and numerous individuals.

For businesses 1 to 5, there is no restriction on them being “for unspecified and numerous individuals”, so for example, if you carry out the transfer of taxable assets as a retail business, you can provide a Simplified Qualified Invoice regardless of the way the business is operated.

Also, whether a business is “one that carries out the transfer of assets to unspecified and numerous individuals” will be determined based on the nature of the individual business.

For example, the following types of businesses would be considered to fall under this category:

- A business where the person carrying out the transfer of assets does not confirm the name or name of the other party and presents the terms of the transaction in advance and carries out the transfer of assets to a wide range of individuals as a matter of course

- A business that, due to its nature, carries out the transfer of assets to a wide range of individuals regardless of the identity of the other party, even if the business operator confirms the name of the other party in the transaction (excluding businesses that require the identification of the other party for each transfer of assets and where the transactions are carried out individually for each other party.)

Reach out to us if you need assistance with JCT compliance

We can help you with everything related to JCT and other tax matters.

If you have any questions about what you should be doing in the upcoming tax year, reach out to us using the contact form below.

Related Posts

- Japanese Tax Authorities Releases FAQ (Ver8) on Crypto Taxes

- Japanese Tax Authorities Releases FAQ (Ver7) on Crypto Taxes

- Japanese Tax Authorities Releases FAQ on NFT Taxes

- Japanese Tax Authorities Release FAQ – Year End Mark-to-Market of Cryptos Held by Entities

- Japanese Consumption Tax (JCT) – Scope and Who Pays the Tax