Overview

Today’s post will be Part 3 of a series on Japanese Consumption Tax (JCT) that we’ve been doing the past few days.

Links to previous JCT related posts:

Introduction to Japanese Consumption Tax (JCT)

Japanese Consumption Tax (JCT) – Scope and Who Pays the Tax

In this post, we’ll be covering transactions that are Non-taxable, or exempt from consumption tax.

Non-taxable (非課税) and Tax-free (不課税)

Before going into the details of non-taxable transactions, it is worthy to understand the concepts of Non-taxable (非課税) and Tax-free (不課税).

非課税 (hikazei) and 不課税 (fukazei) both refer to something that is not subject to taxation.

However, they are written differently in Japanese and have slightly different connotations.

非課税 (hikazei) is a term that is commonly used to describe items or activities that are exempt from taxation, such as certain types of income or goods that are considered necessities.

It is written with the characters 非 (hi), which means “not”, and 課税 (kazei), which means “taxation”.

不課税 (fukazei) is a term that is also used to describe items or activities that are not subject to taxation.

It is written with the characters 不 (fu), which means “not,” and 課税 (kazei), which means “taxation”.

Unlike 非課税, 不課税 is more commonly used to describe items or activities that are exempt from taxation due to their nature or purpose, rather than because they are considered necessities.

Both 非課税 and 不課税 can be translated as “tax-exempt” in English.

However, 非課税 may be more accurately translated as “non-taxable,” while 不課税 may be more accurately translated as “tax-free”.

Non-taxable (非課税) Goods & Services

According to Consumption Tax Law Article 6, some domestic transactions are excluded from the scope of the tax (transfer of taxable assets, etc.):

- considering the nature of the transactions that do not suit the purpose of the taxation

transactions on which taxation is not appropriate due to policy considerations - transactions that are non-taxable (and those that are similar but aren’t) are:

| No | Non-taxable transactions | Similar but taxable |

|---|---|---|

| 1 | Sales or leases of land | Leases of land for less than one month. If land is used in conjunction with the use of facilities such as a parking lot. |

| 2 | Sales of securities | Sales of golf memberships in the form of stock, equity interest, deposit. |

| 3 | Sales of means of payment | When sold as a collector’s item |

| 4 | Interest on deposits, insurance premiums, etc | |

| 5 | Sales of postage stamps, etc., sales of revenue stamps at the designated selling places, sales of certificate stamps by local public organizations | When sold by ticket merchants |

| 6 | Sales of goods stamps, prepaid cards, and other physical stamps | |

| 7 | Fees collected by the government and local public organizations, public service corporations, public interest corporations as consideration for services provided under law and ordinances | |

| 8 | Services related to foreign exchange | |

| 9 | Medical services under the social insurance program | Cosmetic surgeries, hospital costs not covered by social insurance, OTC drugs |

| 10 | Provision of social welfare services | Extra service opted by the service recipient, such as the usage of a special room or special chauffeur service. |

| 11 | Midwifery | |

| 12 | Consideration for cremations and burials | |

| 13 | Sales or leases of certain goods to assist the disabled | |

| 14 | Education services provided at schools | |

| 15 | Sales of educational textbooks | |

| 16 | Leases of residence | Leases of residence for less than one month. |

Tax Exemption for Exports

Transfer of taxable assets etc., which are done as exports from Japan are exempt from consumption tax (Consumption Tax Law Article 7).

Judgment is required in determining whether a transaction is an export transaction, especially in the case of services.

Tax Exemption at Duty Free Shops

There is a special exemption for businesses that sell goods to non-residents (ex. foreign tourists) at Duty Free Shops (Consumption Tax Law Article 8).

When businesses sell certain goods designated in the cabinet order in a manner designated in the cabinet order, such sales are entitled to the exemption.

Goods that are consumed in Japan or the goods sold without any verification of non-residency (presenting passport, etc.) are not exempt.

The operation of Duty Shops requires approval by the district director of the tax office.

The district director of the tax office can revoke approvals if the shops are not operated in compliance with the laws and cabinet order.

Summary

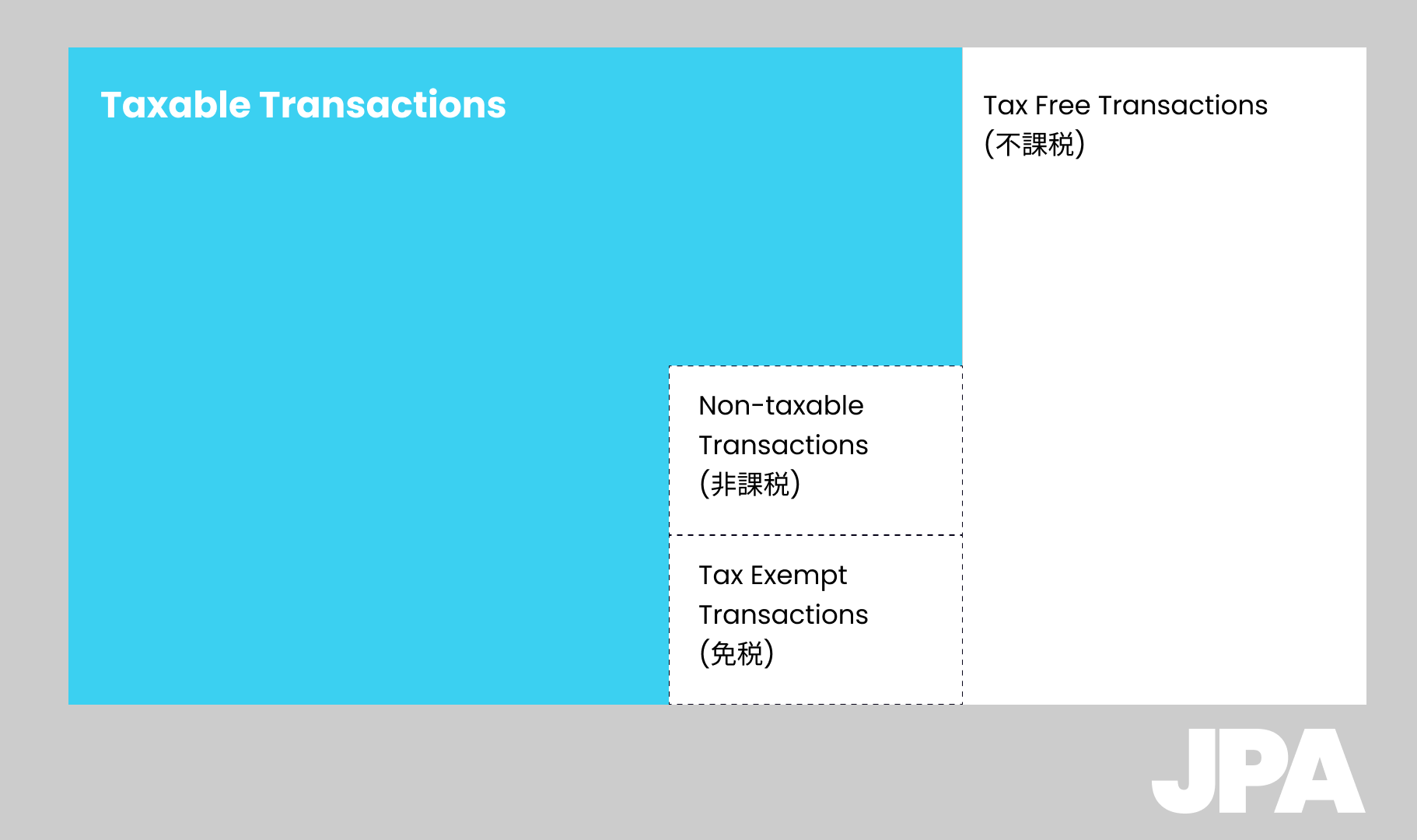

Here is a visualization that summarizes the relationship between Taxable, Non-taxable, Tax-exempt, and Tax-free transactions.