Summary

Starting October 1, 2023, the requirements to deduct import consumption taxes that companies pay when exporting to Japan have changed.

In order to deduct import consumption taxes that you paid in your Japanese consumption tax (JCT) return, you will need to be the Importer of Record (IOR).

If you do not have a physical business location (PE) in Japan, in order for you to be the IOR, you will need to appoint an Attorney for Customs Procedures (ACP).

Who does this concern?

This concerns you if you meet all of the following:

- You export goods to Japan

- You have been paying import consumption taxes

- You do not have a physical business location in Japan

What is Importer of Record (IOR)?

To successfully import goods into Japan, an Importer of Record (IOR) is required under the Japanese Customs Act.

An IOR is responsible for paying taxes, customs duties, as well as ensuring the imported goods are in compliance with Japanese regulations.

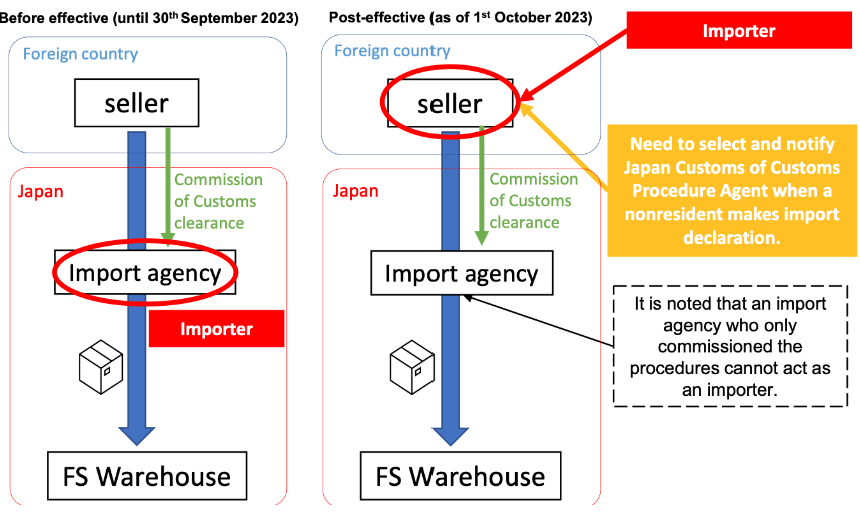

Up until September 2023, non-resident entities who wish to import goods to Japan can assign an IOR (e.g. A logistics company) to act on behalf of them.

However, Japan customs amended the definition of IOR, effective from October, 2023. Your current IOR might no longer qualify after this amendment.

Let’s take a further look.

Clarification of the eligibility of importers by Japan Customs

Japan Customs has amended the import procedures effective as of October, 2023. Under this amendment, non-resident companies that import into Japan (without a sales transaction) generally may no longer use a separate local company (e.g. a logistics company) to act as an IOR.

If the current IOR no longer qualifies under this amendment of eligibility, the non-resident company will be required to be the IOR.

Summary of the clarification of an IOR:

○ a person who has a right to disposition of the imported goods at the time of import declaration.

○ a person who acts on the purpose of the import. For example:

・under lease contracts, a person who rents and uses the imported goods.

・for consignment sales, a person who sells the imported goods in the name of himself/herself (trustee)by accepting the commission.

・for processing or repairing, a person who processes or repairs the importanted goods.

・for disposal, a person who disposes the imported goods.

Example of the case in which the importer IOR should be changed.

(Source: Amendment to Import Declaration Items and Customs Procedure Agent System https://www.customs.go.jp/shiryo/leaflet_jimukanrinin_e.pdf)

What can non-resident entities do to become a Japan IOR?

By appointing an Attorney for Customs Procedures (ACP).

What is Attorney for Customs Procedures (ACP)

Non-resident entities in Japan can appoint a resident company as their ACP.

The ACP will provide support in handling the taxation and other customs procedures.

The non-resident entities can then become an IOR themselves and import goods into Japan.

Why should I appoint an ACP?

Under Japanese tax regulations, only the importer can claim the import consumption tax credit during tax filing.

If another company is used as an importer-IOR, there is a possibility that the import consumption tax paid may no longer be recovered.

By appointing an ACP, a non-resident entity will also be able to become an IOR and deduct import consumption tax during tax filing.

For more details about Japanese consumption tax, please have a quick read here.

We Can Take Care of the ACP Procedures For you

We will introduce the right ACP for your business and specific needs.

Your team at Japan Professional Alliance will streamline your Japan business by taking care of your Japan Consumption Tax and Import Procedures.

Related Posts

- Japanese Tax Authorities Releases FAQ (Ver8) on Crypto Taxes

- Japanese Tax Authorities Releases FAQ (Ver7) on Crypto Taxes

- Japanese Tax Authorities Releases FAQ on NFT Taxes

- Japanese Consumption Tax (JCT) – Non-taxable Good & Services

- Japanese Tax Authorities Release FAQ – Year End Mark-to-Market of Cryptos Held by Entities