How Long Does it Take to Register as a JCT Qualified Invoice Issuer

At JPA, we receive a wide range of questions from our clients regarding the Japanese Invoice System.

One of the most common is “How long it takes to complete JCT (Japanese Consumption Tax) registration”.

In this article, we will explain how long it takes to become a qualified invoice issuer (QII) .

Period Required for Registration

The QII status becomes active on the registration date (i.e. not the notification date).

One can start issuing Qualified Invoices when the QII status becomes active.

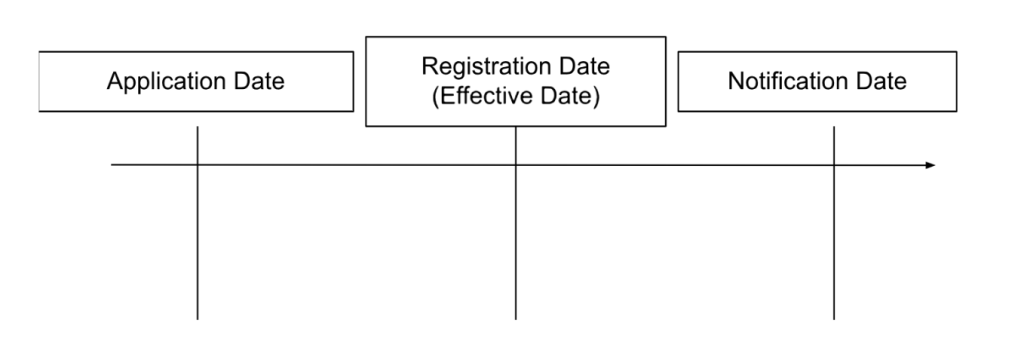

When you apply for registration, the process follows these steps:

Once the Registration Date arrives after applying for registration, the status as a qualified issuer takes effect. However, businesses are only informed of their registration status on the Notification Date, which means there is a time lag.

The key point is that the status as a qualified invoice issuer becomes valid on the Registration Date.

Current Processing Times

Currently, for domestic businesses, it typically takes about one month from application submission to receiving the notification.

For foreign businesses, the review process takes longer than for domestic entities, so early initiation is advised.

Additionally, if there are any errors in the submitted documents, it may further delay the process. Therefore, accurate and timely submission is crucial.

At JPA, we have assisted with over 700 registrations and currently have a 100% success rate.

Can You Specify the Registration Date?

Yes, it is possible to specify the desired Registration Date when applying, provided it is at least 15 days after the submission date.

This means the shortest possible period for registration is 15 days.

Given the time required to prepare the necessary documents and information, we recommend that applicants leave ample time for the process.

Ensuring a Smooth Registration Process

The minimum period required for registration as a qualified invoice issuer is 15 days.

For foreign businesses, more time is generally needed compared to domestic businesses due to additional documentation and questions from the tax authorities.

If there are errors in the submitted documents, it may further delay the registration process, potentially disrupting financial schedules.

At JPA, we offer support with the registration process for qualified invoice issuers, as well as other accounting and tax matters in Japan.

Please feel free to contact us through our inquiry form for assistance.