Acquisition Cost Method Permitted for Specific Self-Issued Crypto Assets

On December 25, 2023, the National Tax Agency (NTA) published a guidance titled “Tax Treatment of Crypto Assets (Information)”.

This is the seventh time (the first was in 2017) that the NTA has officially expressed its views on calculating taxes for cryptocurrency in an FAQ format.

We have been commenting on changes from the previous year’s FAQ every year since 2018.

This year, 11 items were added, but half of them pertain to the content of the “Year End Mark-to-Market Treatment of Cryptocurrencies Held by Entities (Information)” published by the NTA on January 20, 2023.

The important changes in the newly released FAQ Version 8 are the issues related to “Specific Self-issued Crypto Assets” and the concept of “Crypto Assets with Transfer Restrictions and Other Conditions” that will be introduced from 2024.

No change in the departments within the NTA that are involved

This is a comparison of the National Tax Agency’s divisions listed on the cover of the FAQ:

| 2017 (Ver1) | 2018-2023 (Ver2-8) |

|---|---|

| Individual Taxation Division | Individual Taxation Division |

| Tax Consolidation Division | |

| Corporate Taxation Division | |

| Asset Taxation Division | |

| Asset Evaluation Planning Officer | |

| Consumption Tax Office |

In Version 2, the number of divisions increased from one in Version1 to six.

There were no changes in Versions 3,4,5,6,7,8.

There probably won’t be significant changes here going forward, but we’ll keep updating the table for information purposes.

Small change in title

The title of the FAQ changed in Version 2 due to the expansion of the scope of the FAQ from individual income tax.

In Version4, “Cryptocurrency” was changed to “Crypto Asset”.

In Version8, “Crypto Asset” was changed to “Crypto Asset and Others”

| 2017 (Ver1) | 2018-2019 (Ver2-3) | 2020-2022 (Ver4-7) | 2023 (Ver8) |

|---|---|---|---|

| Calculating taxable income related to Cryptocurrency (Information) | Tax Treatment of Cryptocurrencies (Information) | Tax Treatment of Crypto Assets (Information) | Tax Treatment of Crypto Assets and Others (Information) |

Number of FAQ items increased by 11 to 45 items

With Version 3, Corporate Tax was added as a section with new FAQ items.

The number of FAQ items increased from 21 in Version 2 to 32 in Version 3 due to the expansion of the scope of the FAQ.

There were no additional items in Version4.

There was one addition in Version5.

There were no additions in Version6.

There was one addition in Version7.

There were 11 additions in Version8.

In Version8, the Corporate Tax section was subdivided into Crypto Asset Related and Electronic Payment Method Related.

- Income Tax and Corporate Tax

- Income Tax

- Corporate Tax

- Crypto Asset Related

- Electronic Payment Method Related

- Inheritance Tax and Gift Tax

- Income Tax Withholding

- Consumption Tax

- Statutory Declaration

With this in mind, here are the items covered in Version8 of the FAQ:

| No | Item | Ver first appeared in | Changes from Ver6 |

|---|---|---|---|

| 1 Income Tax and Corporate Tax | |||

| 1-1 | Sales of Crypto Asset | 1 | Carried over (significant change in the method for calculating acquisition cost in Ver3) |

| 1-2 | Purchase of Goods with Crypto Asset | 1 | Carried over (significant change in the method for calculating acquisition cost in Ver3) |

| 1-3 | Crypto-to-crypto Trades | 1 | Carried over (significant change in the method for calculating acquisition cost in Ver3) |

| 1-4 | Acquisition Cost of Crypto Asset | 1 | Carried over |

| 1-5 | Acquisition of Crypto Asset Through Forks | 1 | Carried over |

| 1-6 | Acquisition of Crypto Asset Through Mining, Staking, Lending, etc. | 1 | Carried over (Staking and Lending added in Ver6) |

| 1-7 | Crypto Asset Transactions by Non-Residents and Foreign Entities | 7 | Carried over |

| 2 Income Tax | |||

| 2-1 | When to Recognize Income from Crypto Asset Transactions in Total Income | 3 | Carried over |

| 2-2 | Income Classification of Crypto Asset | 1 | Carried over (Significant change to the business income classification criteria) |

| 2-3 | Necessary Expenses of Crypto Asset | 2 | Carried over |

| 2-4 | Cost Basis of the Transferred Crypto Asset | 3 | Carried over |

| 2-5 | Submission of Crypto Asset Measurement Method | 3 | Carried over |

| 2-6 | When Changing the Method of Crypto Asset Measurement | 3 | Carried over |

| 2-7 | When the Purchase Price or the Sale Price of the Crypto Asset is Unknown | 2 | Carried over (addition of the 5% rule in Ver3) |

| 2-8 | Calculation of Taxable Income using the Annual Transaction Report | 2 | Carried over |

| 2-9 | Contents of the Annual Transaction Report | 2 | Carried over |

| 2-10 | When Transferring Crypto Asset at Below Market Value (Zero Value) | 3 | Carried over |

| 2-11 | Treatment of Losses from Crypto Asset Transactions | 1 | Carried over |

| 2-12 | Crypto Asset Margin Trading | 1 | Carried over |

| 2-13 | Crypto Asset Margin Trading (2) | 3 | Carried over |

| 3 Corporate Tax | |||

| 3-1 Crypto Asset Related | |||

| 3-1-1 | When to Recognize Profit From Transferring Crypto Asset | 3 | Carried over |

| 3-1-2 | Cost Basis of Transferred Crypto Asset | 3 | Carried over |

| 3-1-3 | Mark-to-market of Crypto Asset at Year-end | 3 | Carried over (Significant implications from taxation on unrealized gains/losses in Ver3) |

| 3-1-4 | Crypto Assets That Trade in an Active Market | 8 | New (Appeared in "Year End Mark-to-Market Treatment of Cryptocurrencies Held by Entities (Information)") |

| 3-1-5 | Crypto assets that are traded on DEXs | 8 | New (Appeared in "Year End Mark-to-Market Treatment of Cryptocurrencies Held by Entities (Information)") |

| 3-1-6 | Mark-to-Market of Crypto Assets that are Locked for Staking | 8 | New (Appeared in "Year End Mark-to-Market Treatment of Cryptocurrencies Held by Entities (Information)" |

| 3-1-7 | Mark-to-Market of Crypto Assets that are Being Lent | 8 | New (Appeared in "Year End Mark-to-Market Treatment of Cryptocurrencies Held by Entities (Information)" |

| 3-1-8 | Mark-to-Market of Borrowed Crypto Assets | 8 | New (Appeared in "Year End Mark-to-Market Treatment of Cryptocurrencies Held by Entities (Information)" |

| 3-1-9 | Crypto Assets that are Specific Self-issued Crypto Assets | 8 | New |

| 3-1-10 | Crypto Assets Jointly Issued by Multiple Entities | 8 | New |

| 3-1-11 | Crypto Asset Margin Trading | 3 | Carried over |

| 3-1-12 | When to Recognize Profit From Crypto Asset Margin Trading | 3 | Carried over |

| 3-1-13 | Provisional Settlement Profit for Crypto Asset Margin Trading | 3 | Carried over (Significant implications from taxation on unrealized gains/losses in Ver3) |

| 3-2 Electronic Payment Method Related | |||

| 3-2-1 | Tax Implications When Acquiring Electronic Payment Methods | 8 | New |

| 3-2-2 | Payment MethodsTax Implications When Transferring Electronic | 8 | New |

| 3-2-3 | Year-end Tax Implications of Electronic Payment Methods | 8 | New |

| 3-2-4 | Tax Implications of Foreign Currency Denominated Electronic Payment Methods | 8 | New |

| 4 Inheritance Tax and Gift Tax |

|||

| 4-1 | When Crypto Asset is Acquired Through Inheritance or Gift | 2 | Carried over |

| 4-2 | How to Measure Crypto Asset Acquired Through Inheritance or Gift | 2 | Carried over |

| 5 Income Tax Withholding |

|||

| 5-1 | Payment of Salary, etc. Using Crypto Asset | 2 | Carried over |

| 6 Consumption Tax |

|||

| 6-1 | Treatment of Consumption Tax When Transferring Crypto Asset | 2 | Carried over |

| 6-2 | Fees Received from Crypto Lending | 5 | Carried over |

| 7 Statutory Declaration | |||

| 7-1 | Whether to Include Crypto Asset in the Property and Debt Statement | 2 | Carried over |

| 7-2 | How to Record the Value of Crypto Asset in the Property and Debt Statement | 2 | Carried over |

| 7-3 | Whether to Include Crypto Asset in the Foreign Property Statement | 2 | Carried over |

Items 3-1-4 thru 3-1-8 were items that were introduced in “Year End Mark-to-Market Treatment of Cryptocurrencies Held by Entities (Information)” published by the NTA on January 20, 2023.

We covered these items in this article.

Japanese Tax Authorities Release FAQ – Year End Mark-to-Market of Cryptos Held by Entities

The reason why this FAQ is labeled as “information” is because it is not a law or regulation, but rather the view of the NTA.

Although it is not a law, the tax authorities in Japan will refer to this document when verifying the validity of tax calculations regarding crypto.

In practice, I expect various accounting and tax treatments to be based on this FAQ.

This hasn’t changed from Version 1.

Our comments will be inserted using blue text, and the rest is the original content of the FAQ.

The official document can be obtained at the following link:

暗号資産等に関する税務上の取扱い及び計算書について(令和5年12月)|国税庁 (nta.go.jp)

1 Income Tax and Corporate Tax

1-1 Sale of Crypto Asset

Question

Please tell me how to calculate taxable income from the following Crypto Asset transaction.

(Example)

On April 2, I bought 4BTC for JPY 4,000,000.

On April 20, I sold 0.2BTC for JPY 210,000.

(Note) The above transaction does not take into account the transaction fees for buying and selling Crypto Asset.

Answer

In the above example, income is calculated by the following formula:

JPY 210,000 [transfer price] – ( (JPY4,000,000 ÷ 4BTC) [acquisition price per BTC(Note 1)] x 0.2BTC [bitcoin sold] ) [transfer cost] = JPY 10,000 [income](Note 2)

(Note 1)

The amount calculated by either the total average method or the moving average method (if not selected, the total average method for individuals and the moving average method for corporations).

(Note 2)

If there are other necessary expenses, the amount will be the amount minus the amount of those necessary expenses.

When selling (converting to Japanese yen) the crypto asset you hold, income is the difference between the selling price of the crypto asset and the acquisition price of the crypto asset sold.

[Related laws and regulations, etc.]

Income tax law 36, 37, 48-2

The implementing order for income tax law 119-2, 119-5

Corporate tax law 61

The implementing order for corporate tax law 118-6

Our comments:

I have no particular comments regarding the method of calculating the profit when converting cryptocurrency to Fiat (legal tender). (Same comment as Version1)

However, there was a significant change that was made in Version 3.

The general method to be taken when calculating acquisition cost was changed.

Until Version 2, the general method was moving average (total average method was permitted under the condition that it was continuously applied).

In Version 3, the general method was changed to total average method and moving average was made the exception.

In order to use the moving average method, one will now need to submit a declaration to the tax authorities.

This change was made regardless of the tax authorities previously claiming that the moving average method was “the appropriate method”.

This is a clear example of how policy is prioritized over accurate representation of transactions or theoretical arguments.

As we have shared in our previous articles, the moving average method tends to be beneficial to the tax-payer, due to the rounding effect when calculating the cost basis.

We will be touching more on this later in “2-5 Submission of Cryptocurrency Measurement Method”.

They changed the wording from BTC to bitcoin in Version 2 but for some reason they brought back BTC in Version 3.

They also fudged around with the related laws and regulations that were referenced.

In Version 1, transaction fees explicitly included in the acquisition cost.

However, in Version 2 they changed that to “transaction fees are not taken into account”.

Version 3 is the same in that regard.

The handling of fees incurred when acquiring cryptocurrency is covered in “1-4 Acquisition Cost of Crypto Asset”.

1-2 Purchase of Goods with Crypto Asset

Question

Please tell me how to calculate taxable income from the following crypto asset transaction.

(Example)

April 2 Purchased 4BTC for 4,000,000 yen.

October 5 Paid 0.3BTC to purchase goods worth 403,000 yen (including consumption tax).

The exchange rate at the time of transaction was 1 BTC = 1,350,000.

(Note) The above transaction does not take into account the transaction fees for buying and selling crypto asset.

Answer

In the above example, income is calculated according to the following formula:

403,000 yen [goods price (=transfer price of bitcoin] – ( (4,000,000 yen ÷ 4BTC) [acquisition cost per 1BTC] (Note 1) × 0.3 BTC [bitcoin paid] ) [transfer cost] = 103,000 yen (Note 2) [income]

(Note)

(1) The amount calculated by either the total average method or the moving average method (if not selected, the total average method for individuals and the moving average method for corporations).

(2) If there are other necessary expenses, the amount will be the amount minus the amount of those necessary expenses.

If you use the crypto asset you hold for payment when purchasing goods, this means that you transferred the crypto asset you hold, and the difference between the transfer price of that crypto asset and the acquisition cost of that crypto asset will be the income.

[Related laws and regulations, etc.]

Income tax law 36, 37, 48-2

The implementing order for income tax law 119-2, 119-5

Corporate tax law 61

The implementing order for corporate tax law 118-6

Our comments:

I have no particular comments regarding the method of profit calculation.

Change was made in Version 2 which stated that “transaction fees are not taken into account”, whereas Version 1 explicitly included transaction fees in the calculation example.

This change is the same as in “1-1 Sales of Crypto Asset”.

The comment below has been carried over from my commentary for Version 1.

It is not practical to calculate profit and loss every time one pays using bitcoin regularly in their daily lives.

Yes, it is true that the same tax rules apply to the use of foreign currencies.

But few people calculate and report exchange gains and losses when using foreign currencies during their holiday vacations in foreign countries.

We believe that a de minimis rule is necessary to exempt transactions below a certain amount.

1-3 Crypto-to-crypto Trades

Question

Please tell me how to calculate taxable income from the following crypto asset transaction.

(Example)

On April 2, I purchased 4 bitcoin (A) for 4,000,000 yen.

On November 2, I used 1 BTC to purchase 40 XRP.

The market value of XRP at the time of transaction was 1 XRP = 30,000 yen.

(Note)

1 The above transaction does not take into account the transaction fees for buying and selling crypto asset.

2 The above transaction is not considered as a case where the crypto asset is obtained temporarily and only as necessary.

Answer

(30,000 yen x 40XRP) [purchase price of XRP (=transfer price of bitcoin)] – ( (4,000,000 yen / 4BTC) [price per bitcoin (Note 1)] x 1BTC [bitcoin paid] ) [transfer cost] = 200,000 yen(Note 2) [income]

(Note)

- The amount calculated by either the total average method or the moving average method (if not selected, the total average method for individuals and the moving average method for corporations).

- If there are other necessary expenses, the amount will be the amount minus the amount of those necessary expenses.

If you use your own crypto asset to purchase another crypto asset B, you are purchasing crypto asset B with crypto asset A.

Therefore, taxable income from transferring crypto asset A shall be calculated in a way similar to “1-2 Purchase of Goods with crypto asset”.

[Related laws and regulations, etc.]

Income tax law 36, 37, 48-2

The implementing order for income tax law 119-2, 119-5

Corporate tax law 61

The implementing order for corporate tax law 118-6

Our comments:

Here too, a change has been made to “not take into account” the transaction fees when Version 1 was updated to Version 2.

The handling of fees incurred when acquiring cryptocurrency is covered in “1-4 Acquisition Cost of Crypto Asset”.

The comment below has been carried over from my commentary for Version 1.

I have no particular comments on the calculation method for profits related to crypto-to-crypto trades.

I believe most countries consider crypto-to-crypto exchanges as a taxable event.

However, I think a little more effort could have been made in the following two points.

First, it is often unrealistic or difficult to calculate gains and losses for each crypto-to-crypto exchange transaction.

In the case of listed stocks or FX, a transaction occurs and is completed within one brokerage account.

In this case, the calculation of trading gains and losses is easy and can be easily checked in most cases in the service provider’s user account information.

Even if one is using multiple accounts, one can generally determine the overall gain and loss by simply totaling the gains and losses of each account.

However, in the case of cryptocurrencies, one can freely send cryptocurrency between exchanges.

If one sends cryptocurrency purchased from one exchange to another exchange, the receiving exchange does not know the acquisition cost of the cryptocurrency.

Since there is no information on the acquisition cost, it is impossible for the receiving exchange to calculate gains and losses.

Therefore, it is not possible to determine the overall gain and loss by simply summing up the gain and loss data for each exchange if one is using multiple exchanges.

If one has a small number of transactions or is just using a few exchanges, one can use a spreadsheet to try to calculate gains and losses.

As the number of transactions or exchanges used increases, it becomes unrealistic or difficult to perform such calculations.

The second reason is a little more conceptual.

When exchanging one asset for another, the assumption is that it goes through yen once.

If there is a price difference between the assets being exchanged, a gain or loss is realized.

This is easy to understand when thinking of selling Apple stock to buy Google stock (both listed stocks).

One can’t trade AAPL with GOOG directly, they first sell AAPL for fiat, recognize any gain or loss at this point, and use that fiat to buy GOOG.

The thing with cryptocurrency is that BTC and ETH can be traded directly.

In most cases, users do not have the intention of realizing gains or losses when making these transactions.

Generally speaking, cryptocurrency does not give its holders any rights or represent any obligations, unlike financial products or fiat currencies .

In simple terms, holding cryptocurrency means holding a random string of characters called a Private Key.

Exchanging cryptocurrency for cryptocurrency is simply exchanging one string of characters for another.

It is similar to a person with an orange exchanging it for a person with an apple.

Even if the tax law is strictly applied in such a case, it may be subject to taxation.

But from a technical perspective, it seems awkward to me that merely exchanging a string of random letters would be considered a taxable event (this is akin to generating taxable events when exchanging email).

From a practical perspective and a conceptual perspective, I think it is appropriate to tax cryptocurrency when exchanged for fiat.

1-4 Acquisition Cost of Crypto Asset

Question

I purchased crypto asset on a Japanese exchange and paid a transaction fee. In this case, what is the acquisition cost of the purchased crypto asset?

(Example)

On October 2, I purchased 2BTC for JPY 2,000,000. Transaction fee was JPY 550 (including consumption tax).

Answer

The acquisition cost of the acquired crypto asset in the above example is the purchase price of JPY 2,000,000 plus the transaction fee of JPY 550, totaling JPY 2,000,550.

The acquisition cost of crypto asset will be as follows, depending on the method of acquisition.

The acquisition cost includes transaction fees and any other expenses that were required in acquiring the crypto asset.

- When obtained (purchased) by paying a consideration: The amount of the consideration paid at the time of purchase

- When obtained by gift or inheritance (excluding the cases described in 3 below): The value (market value) at the time of the gift or inheritance.

- When obtained by gift on owner’s death, inheritance, or specific inheritance: The amount evaluated by the method chosen by the donor at the time of the donor’s death (the evaluation value of the crypto asset possessed by the donor at the time of death).

- Otherwise: The value (market value) at the time of acquisition.

(Note) ‘Otherwise’ refers to, for example, cases where crypto asset is obtained through exchange, mining, or fork, and in such cases, the acquisition value is the value (market value) at the time of acquisition.

Furthermore, when a crypto asset is obtained through a fork, the acquisition value is 0 yen (refer to “1-5 Acquisition of Cryptocurrency Through Forks”).”

Reference: For a corporation that is a taxable business entity (applying the tax-excluded accounting method) and conducts the above example transaction, what is the acquisition cost of the purchased crypto asset?

The acquisition cost of the crypto asset in the above example is JPY2,000,500 (Note 1, 2).

(Note)

- Under Consumption Tax Law, the transfer of crypto asset and other payment methods is not subject to taxation, but the transaction fee paid to a crypto asset exchange operator as a commission for the transaction is considered a consideration for providing services related to the brokerage, and is subject to consumption tax.

- If the person conducting the transaction in this case is a taxable enterprise under the Consumption Tax Law and applies the tax-excluded accounting method, the amount of consumption tax and other taxes included in the transaction fee (JPY 50 = JPY 500 x 10/110) and the amount of the consideration for the taxable transaction (JPY 500 = JPY 500 – JPY 50) are divided, and the acquisition price of the purchased crypto asset is the sum of the amount of the consideration for the taxable transaction (JPY 2,000,500 = JPY 2,000,000 + JPY 500).

[Related laws and regulations, etc.]

Income tax law 36, 37, 40

The implementing order for income tax law 119-6

Corporate tax law 61

The implementing order for corporate tax law 118-5

Accounting Circular 2

Our comments:

In Version 1, information was provided on the calculation of acquisition cost using the moving average method and the total average method.

In Version 2, the focus of the question has changed to the handling of transaction fees when acquiring cryptocurrencies.

The treatment of including transaction fees incurred when acquiring cryptocurrency in the acquisition price has not changed from Version 1.

The new information being provided in Version 2 was regarding the handling of consumption tax.

Not changed in Version 3 other than reflecting the increase in consumption tax from 8% to 10% in the illustrative example.

There were no changes in Versions 4,5,6,7.

The acquisition cost should be calculated by extracting the consumption tax part from the transaction fees, but it will become quite complicated if the transaction data from the exchange is not formatted to accommodate this.

If you actually start calculating the acquisition cost, you will quickly realize that the handling of transaction fees is complex.

Transaction fees are displayed in various formats in the transaction data depending on the exchange.

(Examples)

fees are generated separately from the order amount

fees are deducted from the order amount

fees are incurred in the base currency

fees are incurred in the trade currency

fees are displayed as negative (rebate)

fees are displayed as rewards in an exchange token

It will be very tedious to sort through each of these scenarios and build logic to calculate total gains and losses.

1-5 Acquisition of Crypto Assets Through Forks

Question

If one acquires a new crypto asset that was born as a result of a chain fork, will this acquisition generate taxable income under individual income tax or corporate tax?

Answer

If one acquires a new crypto asset through a split (fork) of an existing crypto asset, no taxable income will arise.

Under the Income Tax Act, when acquiring something with economic value, the income amount is calculated based on the market value at the time of acquisition.

However, regarding the new crypto asset acquired as a result of a chain fork mentioned in the above question, it is considered that there was no trading market at the time of the fork and the crypto asset did not have value at that time.

Therefore, no income will be generated at the time of acquisition, and income will be generated when the new crypto asset is sold or used.

In that case, the acquisition price will be 0 yen.

The same goes for corporate tax.

The acquisition cost of the newly acquired crypto asset as a result of a split (fork) is 0 yen, and it is considered that there is no amount of profit to be included when calculating taxable income.

[Related laws and regulations, etc.]

Income tax law 36

Corporate tax law 22

Our comments:

In Version 2, bits of language on corporate tax was added, but the content itself is basically the same as Version 1.

Not much change in Version 3 either, other than some words added to clarify that taxable income is not recognized at the time the crypto is received, but can be subject to taxable income recognition in the future when it is sold or converted into another asset.

There were no changes in Versions 4,5,6,7.

The comment below has been carried over from my commentary for Version1.

In the FAQ, it is stated that upon the fork, there is no market and the asset has no value, so the acquisition price is considered to be zero yen, and as a result, there is no income at the time of acquisition.

However, as the existing assumption is that, if an asset is acquired, the income amount is calculated based on the market value at the time of acquisition.

I consider applying this assumption to cryptocurrencies to be an issue in some cases.

Blockchain forks occur at certain frequencies due to how blockchains work.

For example when blocks are consecutively mined in a short period of time, this could lead to forks in the chain.

In the above example, the chain that is ultimately recognized as valid by the majority of nodes in the network is preserved, and the fork chain is discarded.

Therefore, new coins that have value do not arise from all forks.

However, many blockchains are open source and can be freely forked by anyone.

It is possible that a fork could occur without the taxpayer’s knowing.

The taxpayer could unknowingly acquire a cryptocurrency with value.

Also, even if a spot market did not exist at the time a new cryptocurrency was created, it is possible that a price for the cryptocurrency could be formed in a derivative market for the cryptocurrency.

As pointed out in the comments for FAQ 3, we believe that by taxing at the time of exchange for fiat currency or use, it simplifies the calculation of taxable income and protects taxpayers.

1-6 Acquisition of Crypto Asset Through Mining, Staking, Lending, etc.

Question

If crypto asset is obtained through mining, staking, lending, etc., how will it be treated from an income tax or corporate tax perspective?

Answer

Profit from acquiring crypto asset through mining, staking, lending, etc., is subject to income tax or corporate tax.

If one acquires crypto asset through mining, staking, lending, etc. (hereinafter, mining etc.), the amount of income is calculated by subtracting necessary expenses (costs incurred through mining etc.) from the amount of revenue (the market value of the crypto asset at the time it was acquired through mining etc.).

[Related laws and regulations, etc.]

Income tax law 27, 35, 36, 37

Corporate tax law 22, 22-2

Our comments:

Not much change in Version 2 from Version 1 other than the addition of treatment for corporate tax.

There were no significant changes in Versions 3,4,5.

In Version 6, staking and lending were added, but there were no changes in the Answer to the Question.

Staking and lending have various forms, so generalization may not be appropriate, but it is common for the staker or lender to receive tokens as rewards (often referred to as “yield”), for sending tokens to a smart contract and not moving them for a certain period of time.

Most of these services or products are marketed as decentralized, but in reality, they are often developed and operated by a small team and are highly centralized.

Mining does not require tokens, but staking and lending do.

Users that engage in staking and lending will purchase tokens with the expectation of future returns from the efforts of the development and operation by the team.

Therefore, in the United States, these services often lead to discussions of whether they fall under the category of securities.

Personally, I think that mining bitcoin, which is simply generating numbers randomly, and staking and lending are different in nature and substance.

The comment below has been carried over from my commentary for Version 1.

It seems like a reasonable conclusion at first glance, but upon further thought, there appears to be a few issues.

If one interprets receiving bitcoin (cryptocurrency) as payment for providing the service of mining, then yes, the received bitcoin would be considered income.

However, mining itself is not a service, and there is no organization like a company or individual that can be considered the recipient of the service.

Mining bitcoin is merely generating random numbers using a computer.

It is called mining as an analogy because it shares certain similarities as gold mining.

Gold mining companies and oil mining companies do not consider mining gold or oil itself as their business.

They consider selling the mined commodities as their business and income tax is also recognized not at the time of mining, but at the time of sale.

If we think of bitcoin mining in the same way as commodity mining, it seems reasonable to recognize taxable income at the time of sale or use, not at the time of mining.

1-7 Crypto Asset Transactions by Non-Residents and Foreign Entities

Question

I reside in the United States and sold my crypto asset to a Japanese crypto asset exchange.

In this case, do I need to file a tax return in Japan?

Answer

No, you do not need to file a tax return in Japan.

Under Japan’s income tax laws, residents are taxed on their worldwide income, while non-residents are only taxed on income sourced from Japan (domestic-source income).

Moreover, the following types of income are subject to tax on the disposition of assets that are subject to domestic-source income, subject to certain conditions (excluding income attributable to a permanent establishment):

(1) Income from the disposition of domestic real estate;

(2) Income from the disposition of rights or other interests in domestic real estate;

(3) Income from the cutting or disposition of domestic forest land;

(4) Income from the disposition of shares or other securities issued by domestic corporations under certain conditions;

(5) Income from the disposition of shares or other securities of real estate-related corporations; and

(6) Income from the disposition of domestic assets during the period in which a non-resident stays in Japan.

Therefore, income derived from the sale of crypto asset held by a non-resident to a Japanese crypto asset exchange is not subject to income tax in Japan.

The same applies to foreign entities; they are not required to file a tax return in Japan in this case.

(Note) Income derived from the sale of crypto asset held by non-residents or foreign entities to Japanese crypto asset exchanges is also not subject to withholding tax.

[Related Laws and Regulations]

Income tax law 161

Income tax law 212

Income tax order 281

Corporate tax law 138

Corporate tax order 178

Our comments:

This is a new item that was added in Version 7.

We have no particular comments but this got us thinking whether the tax authorities frequently receive questions like this.

Many Japanese cryptocurrency exchanges contract with companies known as LP or MM to provide liquidity on their exchange platforms.

Many of these LPs or MMs are foreign entities.

Since these LPs or MMs buy and sell cryptocurrencies on Japanese exchanges that have engaged them, it is understandable that they would want to obtain clarification from the authorities on whether these activities would lead to tax liability.

2 Income Tax

2-1 When to Recognize Income from Crypto Asset Transactions in Total Income

Question

In what year should the profit generated from crypto asset transactions be recognized as income?

Answer

In principle, it should be considered as income in the year in which the transfer of the crypto asset sold, etc. took place.

However, it is also possible to consider it as income in the year in which the contract for the sale, etc. of the crypto asset was entered.

Profit and loss generated from crypto asset transactions are generally classified as miscellaneous income (other miscellaneous income) (refer to “2-2 Income Classification of Crypto Asset”).

The timing at which such income should be considered as part of the total income is determined based on the nature of the income, in accordance with the timing at which other income should be considered as part of the total income.

Therefore, the timing at which income generated from crypto asset transactions should be recognized in total income is determined based on the nature of the income, in accordance with the timing at which income from transfer of assets is recognized.

[Related laws and regulations, etc.]

Income tax law 35, 36

Income tax basic disclosure 36-12、36-14

Our comments:

This is a new item that was added in Version 3.

We have no particular comments.

2-2 Income Classification of Crypto Asset

Question

Under Income Tax Law, what category of income will gains from crypto asset transactions be classified as?

Answer

In general, gains resulting from the use of crypto assets are classified as miscellaneous income (other miscellaneous income).

Gains and losses arising from crypto asset transactions are considered gain or loss recognized in relation to the relative relationship between domestic currency or foreign currency and therefore are generally classified as miscellaneous income (other miscellaneous income).

However, if the amount of income from crypto asset transactions in that year exceeds 3 million yen, it will be classified into the following income categories:

- If there is record-keeping of accounting documents related to crypto asset transactions, it is generally classified as business income.

- If there is no record-keeping of accounting documents related to cryptocurrency transactions, it is generally classified as miscellaneous income (miscellaneous income related to business).

Furthermore, if “the crypto asset transaction is performed in conjunction with acts that are the basis for various types of income such as business income”, for example, if the business income earner owns the crypto asset as a business asset, and is using the crypto asset as a means of payment when purchasing inventory etc., then it is classified as business income

[Related laws and regulations, etc.]

Income tax law 27, 35, 36

Our comments:

Not much change from Version 1 to Version 2, other than a few words here and there.

There were no significant changes in Versions 3,4,5.

However, there was a significant change in Version 7.

The essence of the content has not changed, so it’s more accurate to say that there were changes in the wording that were significant in nature.

To summarize the content of the FAQ before Version 7:

If profits are made from cryptocurrency transactions, it is generally considered “miscellaneous income”.

However, if cryptocurrency transactions are recognized as a business, it is considered “business income”.

There were no explicit criteria for determining whether a transaction constituted a business, so it was left to judgment of facts and circumstances, which left ambiguity and subjectiveness.

However, in Version 7, specific criteria for classification as “business income” was documented in actual wording.

This is huge.

Those requirements are:

- Keeping accounting documents

- Income amount (crypto gross sales) exceeding 3 million yen

This change should be considered as a change to broadly align tax rules that came out of the revision of the “Basic Directive on Income Tax” dated October 7, 2022, rather than a rule specifically designed for cryptocurrencies.

The purpose of the revision to this Basic Directive is to “clarify the approach to determining whether an income is classified as business income”.

The background to this is the recent trend of increasing side jobs for company employees.

We think what ended up happening is that cryptocurrency traders just happened to be at the receiving end of this favorable income classification criteria that arose from the government’s push to “reform the way of working”.

“Business income” is more advantageous for taxpayers in many ways than “miscellaneous income”.

It is recommended that those who are likely to meet the requirements of “business income” confirm that the above requirements are met during their tax year.

Note that the term “income amount” refers to the gross sale amount of crypto assets.

It does not refer to net profit, so in the case of bitcoin, selling around 1 BTC during the tax year would meet the income requirement.

According to the explanation of the Basic Directive on Income Tax Treatment of Miscellaneous Income (PDF/270KB), the requirement for keeping accounting documents is more important than the income requirement of exceeding 3 million yen in determining the classification as business income.

Even if the income amount is less than 3 million yen, if the requirement for keeping accounting documents is met, the business income classification will not be immediately denied.

However, clearing the quantitative threshold of exceeding 3 million yen provides more peace of mind in removing uncertainty.

2-3 Necessary Expenses of Crypto Asset

Question

In the case of reporting income from the sale of crypto asset, what expenses are considered necessary business expenses?

Answer

Necessary expenses when calculating taxable income from the sale of crypto asset include, for example, the following costs

- Transfer cost of the crypto asset sold

- Transaction fees paid for the sale of the crypto asset

In addition, the cost of using the internet or smart phones, the cost of purchasing a computer, etc. can also be included in the necessary expenses, as long as the amount of such expenses is deemed to be directly necessary for the sale of the crypto asset.

In principle, income from the sale of crypto asset is classified as miscellaneous income (other miscellaneous income) (see “2-2 Income Classification of Crypto Asset”).

The amount that can be included in the necessary expenses is the transfer cost of the crypto asset and other expenses directly related to the sale of the crypto asset.

Please note the following items regarding necessary expenses.

(1) Regarding the usage fees for internet, smartphones, and other communication lines, they are generally paid in lump sum, without clear segregation of whether they were for cryptocurrency transactions or other uses.

However, in terms of such expenses, only when the usage fees for cryptocurrency transactions can be clearly separated, the clearly separated amount can be included as necessary expenses.

(2) For assets such as a personal computer that have a useful life of more than one year and exceed a certain monetary value, the necessary expenses should be divided over the entire useful life of the asset (such expenses are called “depreciation expenses”), rather than being expensed in a lump sum for the year.

If a cryptocurrency transaction is classified as business income or miscellaneous income (miscellaneous income related to business), the amount of expenses incurred for sales expenses, general administrative expenses, and other expenses related to the business that generates income in that year can be included as necessary expenses.

[Related laws and regulations, etc.]

Income tax law 37, 45, 48-2

Income tax law enforcement ordinance 96

Our comments:

This was a new item introduced in Version 2.

No significant changes in Versions 3,4,5,6.

Although there were some changes in the wording in Version 7, there seems to be no change in the conclusion that the following amounts can be included as necessary expenses:

(1) Direct expenses such as the transfer cost of cryptocurrencies and other expenses directly incurred when selling cryptocurrencies.

(2) Indirect expenses such as sales expenses, general administrative expenses, and other expenses related to the business that generates income in that year.

Judgment is required when determining what expenses can be included in necessary expenses.

The best approach would be to keep all your receipts during the year and consult with your tax accountant.

2-4 Cost Basis of the Transferred Crypto Asset

Question

I have continuously bought and sold the same type of crypto asset as follows.

What is the transfer cost for the sale of this crypto asset?

(Example)

I first purchased bitcoin on April 1 and subsequently bought and sold it several times as shown below.

The total amount of sales (quantity) for the year was 5,295,000 yen (5 BTC) and the total amount of purchases (quantity) was 4,037,800 yen (6.5 BTC)

(Breakdown)

・ On April 1, 4 BTC was purchased for 1,845,000 yen (on hand balance 4 BTC)

・ On June 20, 2 BTC was purchased for 1,650,000 yen (on hand balance 6 BTC)

・ On July 10, 2 BTC was sold for 2,400,000 yen (on hand balance 4 BTC)

・ On September 15, 0.5 BTC was purchased for 542,800 yen (on hand balance 4.5 BTC)

・ On November 30, 3 BTC was sold for 2,895,000 yen (on hand balance 1.5 BTC)

(Note) The above transactions do not take into account trading fees for crypto asset.

Answer:

In the above example, the total average method results in a transfer cost of 3,106,000 yen, and the moving average method results in a transfer cost of 3,080,200 yen.

When calculating the income from the sale of multiple crypto assets, it is necessary to calculate the transfer cost.

The transfer cost is calculated by subtracting the (3) valuation of crypto asset held at the end of the year (December 31) from the sum of (1) valuation of crypto asset held at the beginning of the year (January 1) from the previous year and (2) total acquisition cost of crypto asset acquired during the year for each type of crypto asset (for example, bitcoin, etc.).

This “valuation of crypto asset held at the end of the year” is obtained by multiplying “the acquisition cost per unit at the end of the year” by “the number of units held at the end of the year”, and “the acquisition cost per unit at the end of the year” is calculated using either the “total average method” or the “moving average method”.

In the above example, the transfer cost is as follows depending on the evaluation method:

Total average method: The method of calculating the “acquisition cost per unit at the end of the year” by dividing the sum of the valuation of a crypto asset held at the beginning of the year and the total acquisition cost of that crypto asset acquired during the year by the total quantity of that crypto asset.

Moving average method: The method of calculating the “acquisition cost per unit at the end of the year” by adding the acquisition cost of a crypto asset acquired at each acquisition point to the total acquisition cost of that crypto asset held at that acquisition point and dividing it by the total quantity of that crypto asset held at that acquisition point.

When using the total average method

The “acquisition cost per unit at the end of the year” is 621,200 yen, and the “valuation of crypto asset held at the end of the year” is 931,800 yen according to the following calculation.

Therefore, the transfer cost is 3,106,000 yen (4,037,800 yen – 931,800 yen).

<Calculation>

(1) Total acquisition cost of the same type (name) of crypto asset acquired during the year ÷

(2) Quantity of the same type (name) of crypto asset acquired during the year =

(3) Acquisition cost per unit at the end of the year

(Note) If there is crypto asset carried over from the previous year, add the value and quantity to 1 and 2 respectively.

(1) Total acquisition cost of bitcoin acquired during the year 4,037,800 yen

(2) Quantity of bitcoin acquired during the year 6.5BTC

(3) Acquisition cost per unit at the end of the year (1÷2) 621,200 yen

(4) Valuation of bitcoin held at the end of the year (3×1.5BTC) 931,800 yen

When using the moving average method

The “acquisition cost per unit at the end of the year” is 638,400 yen, and the “valuation of crypto asset held at the end of the year” is 957,600 yen according to the following calculation.

Therefore, the transfer cost is 3,080,200 yen (4,037,800 yen – 957,600 yen).

<Calculation>

When acquiring crypto assets of different types (names), revise the average unit price using the following calculation formula.

(1) Total book value of the same type (name) of crypto asset held at the acquisition point ÷

(2) Quantity of the same type (name) of crypto asset held at the acquisition point =

(3) Average unit price at the acquisition point

(Note)

1 If there is crypto asset carried over from the previous year, add the value and quantity to 1 and 2 respectively.

2 The “average unit price at the acquisition point” calculated from the closest date to December 31 of that year will be the “acquisition cost per unit at the end of the year”.

(1) Average unit price at acquisition point (April 1)

- (1) Total book value of bitcoin held at acquisition point 1,845,000 yen

- (2) Quantity of bitcoin held at acquisition point 4BTC

- (3) Average unit price at acquisition point (1÷2) 461,250 yen

(2) Average unit price at acquisition point (June 20)

- (1) Total book value of bitcoin held at acquisition point 3,495,000 yen

- (461,250 yen × 4BTC) [book value of crypto asset held at acquisition] + 1,650,000 yen [acquisition cost on June 20th] = 3,495,000 yen

- (2) Quantity of bitcoin held on the acquisition date 6 BTC

- (3) Average acquisition price on the acquisition date (1 ÷ 2) 582,500 yen

(3) Average acquisition price on the acquisition date (September 15)

- (1) Total book value of bitcoin held on the acquisition date 2,872,800 yen

- (582,500 yen x 4 BTC) [book value of cryptocurrency held at the time of acquisition] + 542,800 yen [purchase amount on September 15th] = 2,872,800 yen

- (2) Quantity of bitcoin held on the acquisition date 4.5 BTC

- (3) Average acquisition price on the acquisition date (1 ÷ 2) 638,400 yen

(4) Unit acquisition price at the end of the year 638,400 yen

- = Average acquisition price on September 15 638,400 yen

(5) Evaluation of bitcoin held at the end of the year

- 638,400 yen (unit acquisition price at the end of the year) x 1.5 BTC (quantity held at the end of the year) = 957,600 yen

To make calculating the income from the sale, including the transfer cost of crypto asset fairly simple, it is possible to create a “Crypto Asset Calculation Sheet (for the total average method or the moving average method)” based on the “Annual Trading Report” sent by the crypto asset exchange operator. (Refer to “2-8 Calculation of Taxable Income using the Annual Transaction Report”)

The “Crypto Asset Calculation Sheet (for the total average method or the moving average method)” can be found on the website of the National Tax Agency.

[Related laws and regulations, etc.]

Income tax law 48-2

Income tax law enforcement ordinance 119-2

Our comments:

This is a new item introduced in Version 3.

I have no particular comments as it is only a basic explanation of the moving average and total average method.

2-5 Submission of Crypto Asset Measurement Method

Question

I recently acquired my first crypto asset, but I heard that I need to elect a method for evaluating it.

Can you tell me the specific steps in submitting an election?

Answer

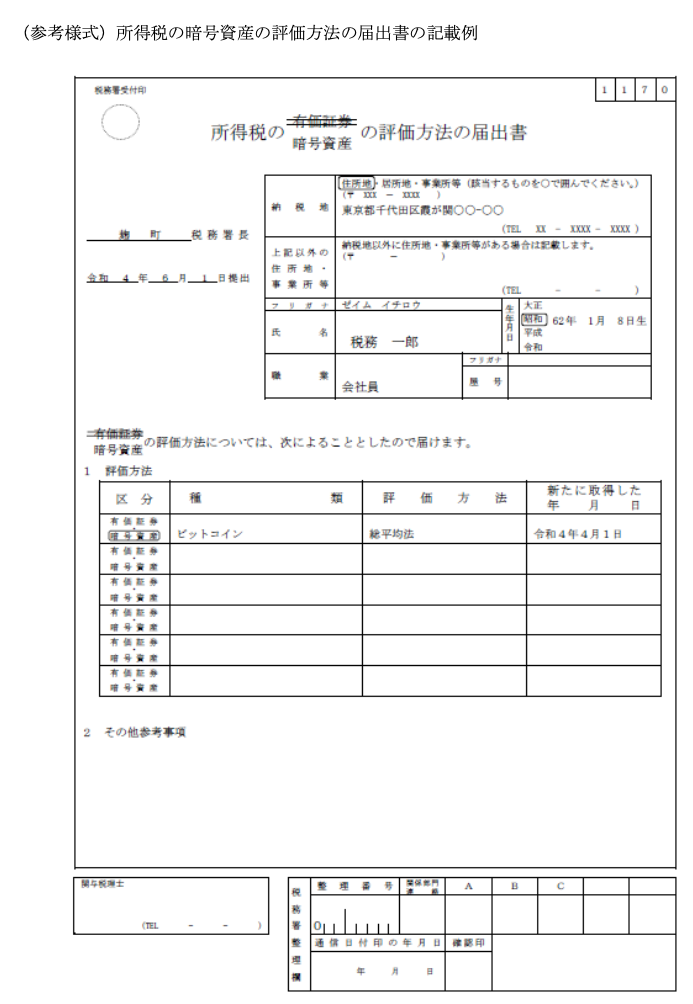

In order to file your income tax return, it is necessary to submit a “Notice of Method of Evaluation of Crypto Asset for Income Tax” to the head of the tax office in the area where you are a taxpayer by the deadline for submitting your income tax return (generally March 15 of the following year) after you first acquired your crypto asset.

As stated in “2-4 Cost Basis of Crypto Asset,” the evaluation value of the crypto asset you own at the end of the year (December 31) is calculated using either the “Total Average Method” or the “Moving Average Method” as the basic calculation for determining the transfer price of crypto asset such as selling it.

These evaluation methods are selected for each type of crypto asset (name) and if you

(1) acquire a crypto asset for the first time or

(2) acquire a different type of crypto asset, you must submit a notice (Notice of Method of Evaluation of Crypto Asset for Income Tax) that includes the selected evaluation method and other necessary information to the head of the tax office in the area where you are a taxpayer by the deadline for submitting your income tax return (generally March 15 of the following year).

(Note)

(1) This treatment was implemented as a result of revisions to the Income Tax Law, etc. in 2019.

(2) If the Notice of Method of Evaluation is not submitted, the default evaluation method will be “Total Average Method”.

(3) An example of the Notice of Method of Evaluation of Crypto Asset for Income Tax is provided on the next page.

[Related Laws and Regulations]

Income tax law 48-2

Enforcement order of the income tax law 119-2, 119-3, 119-5

Cabinet order amending part of the enforcement order of the income tax law (No. 95 of 2019) Article 4

This form can be downloaded from the National Tax Agency’s website.

If you have multiple types of crypto asset and are unable to list them all in the “1 Evaluation Method” section of the form, please list the relevant items on a separate sheet and submit it along with the form.

Our comments:

This was a new item that was introduced in Version 3.

There was a significant change that was made in Version 3.

The general method to be taken when calculating acquisition cost was changed.

Until Version 2, the general method was moving average (total average method was permitted under the condition that it was continuously applied).

In Version 3, the general method was changed to total average method and moving average was made the exception.

In order to use the moving average method, one will now need to submit a declaration to the tax authorities.

This change was made regardless of the tax authorities previously claiming that the moving average method was “the appropriate method”.

As we have shared in our previous articles, the moving average method tends to be beneficial to the tax-payer, due to the rounding effect when calculating the cost basis.

Furthermore, the moving average method, in which the most recent prices are more likely to be reflected in the cost, is superior to the total average method from the perspective of accurate cost calculation.

This is a clear example of how policy is prioritized over accurate representation of transactions or theoretical arguments.

Whether or not it would be better to submit and elect using the moving average method would depend on various factors, and careful consideration should be given.

The fact that the cost basis calculation method election can be made on a coin by coin basis is noteworthy (i.e. choose total average method for bitcoin and moving average method for Doge).

2-6 When Changing the Method of Crypto Asset Measurement

Question

I submitted a “Notice of Method of Evaluation of Crypto Asset for Income Tax” electing the total average method as the evaluation method for crypto asset, but I am now considering changing the evaluation method to the moving average method.

Can you tell me the specific procedures for this change?

Answer

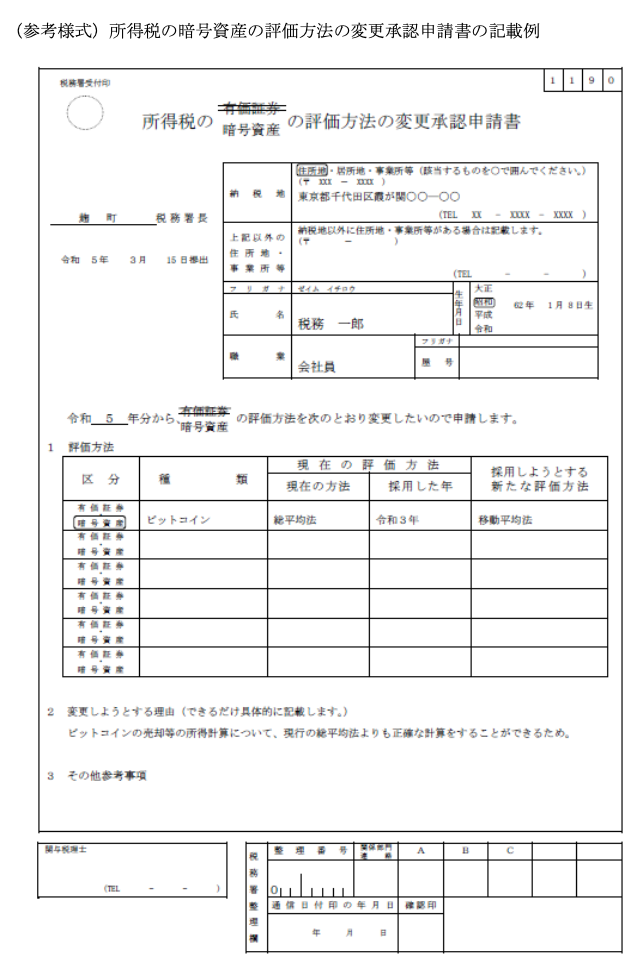

In order to change the evaluation method, it is necessary to submit an application for change of evaluation method (Notice of Method of Evaluation of Crypto Asset for Income Tax) to the head of the local tax office in the jurisdiction of the taxpayer, by March 15 of the year in which you wish to change the evaluation method, and to receive the approval of the change.

As mentioned in “2-5 Submission of Crypto Asset Measurement Method” submitting a “Notice of Method of Evaluation of Crypto Asset for Income Tax” is required in order to select either “total average method” or “moving average method” as the evaluation method for the evaluation of crypto asset held at the end of the year (December 31), which forms the basis for calculating the transfer price relating to the sale, etc. of crypto assets.

If you want to change this elected evaluation method (including the case where the evaluation method was “total average method” for those who did not notify the evaluation method), you need to submit an application letter (Notice of Change of Evaluation Method for Crypto Asset for Income Tax) to the head of the tax office in charge of the tax return location, by March 15 of the year you want to change, containing the designated matters, including the evaluation method you want to change.

Note:

- If no notice of approval or rejection is received by December 31 of the year in which the application is submitted, the change will be deemed to have been approved.

- If the change is made within a period of 3 years from the adoption of the previous evaluation method, or if the proposed evaluation method makes it difficult to calculate the income amount appropriately, the application may be rejected.

- An example of the application for change of evaluation method can be found on the next page.

[Related Laws and Regulations]

Income tax law 48-2

Enforcement order of the income tax law 101, 119-2, 119-4

Income tax basic disclosure 47-16-2、48-2-3

This form can be downloaded from the National Tax Agency’s website.

If you are making changes to multiple types of crypto asset and are unable to list them all in the “1 Evaluation Method” section of the form, please list the relevant items on a separate sheet and submit it along with the form.

Our comments:

Until Version 2, the calculation method for the acquisition price was left to the judgment of the taxpayer.

However, from Version 3, the taxpayer will need to obtain approval in order to change the calculation method for the acquisition price.

Below are my comments carried over from Version 1.

In the FAQ, both the moving average method and the total average method (with the condition of continuous application) are permitted, and the moving average method is considered “appropriate”. (In Version 1 and 2, the authorities had stated that the moving average method was the “appropriate” method. Regardless, in Version 3, they changed the default method to total average method, even though it is an inferior method in terms of accuracy compared to moving average method.)

However, there are other methods of calculating cost that are considered appropriate besides the moving average method and the total average method.

The first-in, first-out method and the individual cost method are examples.

In the United States, the first-in, first-out method is the basis for calculating the acquisition cost of cryptocurrency.

The individual cost method is also permitted under the condition that transaction records are properly maintained and the cryptocurrency itself that was the subject to the transaction can be uniquely identified.

Cryptocurrencies using the UTXO (Unspent Transaction Output) model, such as Bitcoin, allow individual identification of the cryptocurrency that was the subject of the transaction. (Ethereum is account-based and does not have UTXO, so it is not possible to individually identify the ETH that was the subject of the transaction)

Since the assets that were the subject of the transaction can be individually identified, it should be said that the individual cost method most accurately represents the cost and is most appropriate as the cost calculation method.

bitcoin is an asset with completely new properties that have never existed before.

Instead of simply applying the framework for existing assets, it is better to discuss how to faithfully represent the actual substance of the transaction.

The other point of interest is the section where it says “fractions of less than 1 yen that occur in the acquisition cost calculation may be rounded up”

If the cost increases, the gain will be calculated less, so the conclusion is that rounding up the fraction is advantageous.

Whether the moving average or the total average is advantageous is case-by-case.

Except in cases where the result is clear, it seems best to adopt the moving average method, considering the benefits of fraction rounding.

2-7 When the Purchase Price or Sale Price of the Crypto Asset is Unknown

Question

I have traded crypto asset this year, but I have not kept a record of the transactions, so I do not know the acquisition cost or sale price of the crypto asset.

Is there a way to check these prices?

Answer

You can confirm the acquisition cost and sale price of crypto asset transactions according to the following categories:

1 Crypto asset transactions through domestic crypto asset exchanges

For crypto asset transactions after January 1, 2018, the National Tax Agency requests that crypto asset exchanges provide an “Annual Trading Report” containing the following information to individual taxpayers.

- Annual Purchase Quantity: The quantity of crypto asset purchased during the year

- Annual Purchase Amount: The amount of money spent on purchasing crypto asset during the year (acquisition cost)

- Annual Sale Quantity: The quantity of crypto asset sold during the year

- Annual Sale Amount: The amount of money received from selling crypto asset during the year

If you do not have an Annual Trading Report, please request a new one from the crypto asset exchange.

(Note) For transactions before 2018, an Annual Trading Report may not have been provided. In that case, please refer to the following category 2 to confirm the acquisition cost and sale price of crypto asset yourself.

2 Crypto asset transactions other than those in category 1 (transactions through foreign crypto asset exchanges, transactions between individuals)

To confirm the acquisition cost and sale price of individual cryptocurrencies, you can use the following methods, for example:

- Confirm the acquisition cost and sale price of crypto asset by checking the withdrawal status of the bank account used to purchase crypto asset and the deposit status of the bank account used to sell crypto asset.

- Confirm the acquisition cost and sale price of crypto asset by using the transaction history of crypto asset transactions and the transaction market published by the crypto asset exchange (Note).

(Note) In the case of transactions between individuals, use the transaction market of the crypto asset exchange that you mainly use.

If the correct amount is found after submitting the final tax return, please correct the content of the final tax return (request for a revision or correction).

In addition, it is permitted to consider the acquisition cost of the crypto asset sold as 5% of the selling price.

For example, if a crypto asset is sold for 5 million yen, the acquisition cost of that crypto asset can be deemed as 250,000 yen, which is 5% of the selling price.

[Related laws and regulations, etc.]

Income tax basic disclosure 48-2-4

Our comments:

This was a new item introduced in Version 2.

In Version 3, the 5% rule, which states that if the acquisition cost of cryptocurrency is unknown, it may be deemed as 5% of the selling price.

2-8 Calculation of Taxable Income using the Annual Transaction Report

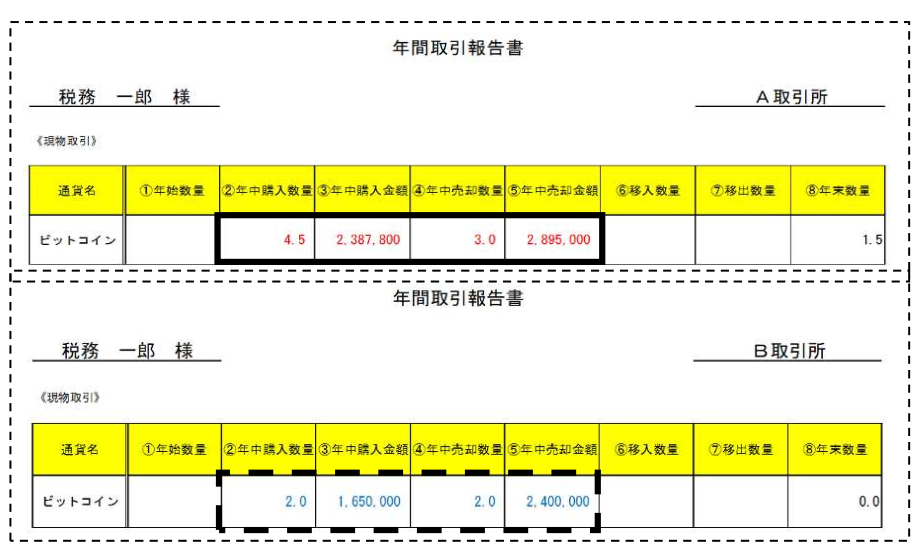

Question

Crypto Asset exchange A and B sent the following annual transaction reports.

Please teach me how to calculate the amount of income from crypto asset using these annual transaction reports.

Answer

By inputting the red and blue portions of the annual transaction report into the “Calculation Sheet for Crypto Asset (using the total average cost method)” published on the National Tax Agency homepage, you can easily calculate the amount of income.

In the above case, the amount of income from crypto asset is 2,189,000 yen.

Please refer to the next page for an example of calculating the “Calculation Sheet for Crypto Asset (using the total average cost method)”.

[Related laws and regulations, etc.]

–

Our comments:

This was a new item introduced in Version 2.

I have no particular comments.

2-9 Contents of the Annual Transaction Report

Question

An annual transaction report was sent from a crypto asset exchange, but what is recorded in this annual transaction report?

Answer

- Beginning quantity for the year: The quantity of crypto asset holdings as of January 1 of that year

- Purchased quantity during the year: The quantity of crypto asset purchases made during the year

- Purchased amount during the year: The amount of money spent on crypto asset purchases during the year (acquisition cost)

- Sold quantity during the year: The quantity of crypto asset sales made during the year

- Sold amount during the year: The amount of money received from crypto asset sales during the year

- Transfer-in quantity: The quantity of crypto asset received in the account other than purchases made during the year

- Transfer-out quantity: The quantity of crypto asset paid out from the account other than sales made during the year

- End-of-year quantity: The quantity of crypto asset holdings as of December 31 of that year

- Total profit or loss: The total amount of profit or loss from crypto asset margin trading for the year

- Transaction fee: The amount of transaction fees paid to the crypto asset exchange during the yea

* In cases where crypto asset sales, purchases, etc. are made using a foreign currency, the amount converted into yen based on the TTM of the telegraphic trading market at the time of the transaction is the basis for each item.

In the case of the following transactions, the contents of each column are as follows:

(1) In the case of receiving crypto asset from a crypto asset exchange for free

“Sold quantity during the year”: –

“Sold amount during the year”: The value (market value) of the crypto asset received

“Purchased quantity during the year”: The number of crypto asset received

“Purchased amount during the year”: The value (market value) of the crypto asset received”

(2) When settling with crypto asset

- If you converted the crypto asset to fiat currency and made the payment through a crypto asset exchange:

“Annual Sale Quantity”: The quantity of crypto asset that was converted to fiat currency

“Annual Sale Amount”: The value (market value) of the crypto asset that was converted to fiat currency - If you made the payment directly with the crypto asset:

“Transfer Out Quantity”: The quantity of crypto asset used for the payment

(3) If you exchanged crypto asset A for crypto asset B through a crypto asset exchange:

A crypto asset’s “Annual Sale Quantity”: The quantity of crypto asset A that was exchanged

A crypto asset’s “Annual Sale Amount”: The value (market value) of the crypto asset B that was obtained

B crypto asset’s “Annual Purchase Quantity”: The quantity of crypto asset B that was obtained

B crypto asset’s “Annual Purchase Amount”: The value (market value) of the crypto asset B that was obtained

Please note that the format of the annual trading report may vary depending on the crypto asset exchange.

[Related laws and regulations, etc.]

–

Our comments:

This is a new item introduced in Version 2.

I have no particular comments on this item.

2-10 When Transferring Crypto Asset at Below Market Value (Zero Value)

Question

As in the following example, I sold crypto asset at the same price as the acquisition price, so there is no profit from the sale, but the sales amount was lower compared to the market price (market value) at that time.

Is it necessary to file a tax return even though there is no income other than the income from this sale?

(Example)

- I bought 1 BTC for 450,000 yen on April 9.

- I sold 1 BTC for 450,000 yen on May 20.

The exchange rate at the time of sale was 1 BTC = 1,000,000 yen.

(Note) Transaction fees for buying and selling crypto asset are not taken into account in the above example.

Answer

In the above example, for the calculation of miscellaneous income, the total income amount is calculated as 700,000 yen (equivalent to 70% of the market value), so it is necessary to report an income amount of 250,000 yen.

After April 1, 2019, when an individual transfers crypto asset to another individual or corporation by means of a transfer (Note 1) in consideration of a value that is significantly lower than the market value, it is necessary to include a portion of the difference between such value and the market value of such crypto asset that is considered a gift in essence (Note 2), at the time of such transfer in the total income amount for miscellaneous income, etc. (Note 3)

(Note)

1 “Transfer by means of a value that is significantly lower than the market value” refers to selling for less than 70% of the market value.

2 The amount “considered as a gift in essence” means the amount after subtracting the consideration amount from the equivalent of 70% of the market value.

3 In case an individual who acquired a crypto asset transfers it, the acquisition price of the crypto asset that serves as the basis of the calculation will be the total of the consideration and the amount considered as a gift, which is the difference between the price of the crypto asset at the time of acquisition and the amount of the consideration.

4 This applies to income tax from 2019 onwards.

In the above (example), the amount to be included in the total income is 840,000 yen because it meets the criteria of a low-value transfer.

(Calculation)

Determination of whether or not it falls under low-value transfer

(1) Sales price: 450,000 yen

(2) Amount equivalent to 70% of market value: 1,000,000 yen x 70% = 700,000 yen

(3) Because (1) < (2), the sales price is less than the amount equivalent to 70% of the market value, the transaction is deemed a low-value transfer.

Total Income Calculation

When a transaction is deemed a low-value transfer, the total income must include the actual sales price and the difference between the actual sales price and the amount equivalent to 70% of the market value.

450,000 yen [Actual sales price] + (700,000 yen – 450,000 yen) [Difference between actual sales price and the amount equivalent to 70% of the market value] = 700,000 yen [Total income]

Taxable Income Calculation

700,000 yen [Total income] – 450,000 yen [Transfer cost] = 250,000 yen [Taxable Income]

Also, on and after April 1, 2019, if crypto asset is transferred to other individuals or corporations through gifts (excluding death-related gifts) or inheritance (excluding specific inheritance for inheritors), the value (market value) of the crypto asset at the time of the gift or inheritance must be included in the total income for miscellaneous income, etc.

(Note)

1 If an individual acquires a crypto asset and transfers them, the acquisition cost of the crypto asset will be the value of the cryptocurrency asset at the time of gift or inheritance.

2 This applies to income tax from 2019 onwards.

3 If an individual acquires a crypto asset through inheritance, gift, or donation, they will be subject to inheritance tax or gift tax.

Please see “4-1 When Crypto Asset is Acquired Through Inheritance or Gift” for more information.

[Related Laws and Regulations]

Income tax law 40

Enforcement order of the income tax law 87

Income tax basic disclosure 40-2, 40-3

Our comments:

This was a new item that was added in Version 3.

We have no particular comments.

2-11 Treatment of Losses from Crypto Asset Transactions

Question

I incurred a loss in the amount of miscellaneous income through crypto asset trading.

Can this loss be used to offset other income such as salary income?

Answer

A loss incurred in the calculation of miscellaneous income cannot be used to offset other income.

Under the Income Tax Act, income that can be used to offset other income includes real estate income, business income, mountain forest income, and transfer income.

Since miscellaneous income does not fall under these categories of income, a loss incurred in the calculation of miscellaneous income cannot be netted with other income, even if there is such a loss.

[Related laws and regulations, etc.]

Income tax law 69

Our comments:

No significant changes from Versions 1,2,3,4.

While losses cannot from miscellaneous income can’t be used to offset income from other income categories, that changes if the income is classified as other than miscellaneous, such as business income or transfer income.

2-12 Crypto Asset Margin Trading

Question

Will crypto asset margin trading be subject to the separate taxation system for declaration, similar to foreign exchange margin trading (commonly known as FX)?

Answer

Income from margin trading of crypto asset is not subject to the separate reporting taxation (special taxation of miscellaneous income related to futures trading) specified in the Special Taxation Measures Act, so it will be subject to comprehensive taxation and must be reported.

Foreign exchange margin trading (so-called FX) falls under financial product futures trading under the Financial Instruments and Exchange Law, so it is subject to separate reporting taxation.

Though margin trading of crypto asset is considered futures trading of financial instruments etc. as does FX, it is excluded from separate reporting taxation under the Special Measures Act, and therefore, income from such transactions will be reported under comprehensive taxation.

[Related laws and regulations, etc.]

Income tax law 35

Special Tax Measures Act 41-14

Our comments:

The content is pretty much the same as Version 1,2,3.

The amendment to the Financial Instruments and Exchange Law has resulted in crypto asset derivatives falling under the purview of the law.

Previously, crypto exchanges only needed to register with the Financial Services Agency as required by the Payment Services Act, but now, registration as a Type 1 Financial Instruments Business Operator is necessary to provide services such as crypto margin trading and FX.

The comment below has been carried over from my commentary for Version 1,2,3.

I am personally opposed to special tax treatments in general.

Lowering the tax rate is never a bad thing, but tax exemptions that favor only a certain group of people are not fair.

2-13 Crypto Asset Margin Trading (2)

Question

Please tell me the method of calculating the amount of income in the case of the following crypto asset transactions based on credit.

(Example)

・ Went short 1BTC for 1,000,000 yen on September 1.

・ Went long 1BTC for 800,000 yen on September 24.

(Note) In the above transactions, fees for buying and selling crypto asset are not considered.

Answer

In the above example, the income amount is calculated as follows:

(Formula)

1,000,000 yen [selling price] – 800,000 yen (Note 1) [buying price] = 200,000 yen (Note 2)

(Note)

1 The transfer cost is the amount calculated by the specific identification method.

2 If there are other necessary expenses, the amount after deducting such expenses.

A crypto asset credit transaction is a buying and selling of crypto asset that is conducted based on credit from a crypto asset exchange operator.

In this method of crypto asset credit trading, when buying and selling crypto asset and then settling by buying and selling the same type of crypto asset, the income amount is the difference between the normal amount of consideration to be received by the transfer of crypto asset (selling price) (Note 1) and the consideration amount of the crypto asset at the time of buying (buying price) (Note 2).

In addition, income from crypto asset credit transactions is considered income for the year in which the transaction is settled.

(Note)

1 When a seller conducts a sale, the interest received from the crypto asset exchange operator is included in the sale price, and the so-called commodity loan fee paid to the crypto asset exchange operator is deducted from the sale price.

2 When a buyer conducts a purchase, the interest paid to the crypto asset exchange operator is included in the purchase price, and the so-called commodity loan fee received from the crypto asset exchange operator is deducted from the purchase price.

[Related Laws and Regulations]

Enforcement order of the income tax law 119-7

Income tax basic disclosure 36・37, Article 22

Our comments:

This was a new item that was added in Version 3.

We have no particular comments.

3 Corporate Tax

3-1 Crypto Asset Related

3-1-1 When to Recognize Profit From Transferring Crypto Asset

Question

When selling crypto asset, buying goods with crypto asset, or exchanging crypto asset, which fiscal year should the resulting transfer gains or losses be recorded in?

Answer

The transfer gains or losses resulting from selling, buying, or exchanging crypto asset should be recorded in the fiscal year in which the contract for the sale, purchase, or exchange of crypto asset was made (i.e., the date of the agreement).

For transactions involving the sale of crypto asset (1-1 Sales of Crypto Asset), the purchase of goods with crypto asset (1-2 Purchase of Goods with Crypto Asset), or the exchange of crypto asset (1-3 Crypto-to-crypto Trades), as they are all considered a transfer of crypto asset, the transfer gains or losses related to these transactions should be recorded in the fiscal year in which the agreement for the transfer was made (i.e., the date of the agreement).

[Related Laws and Regulations]

Corporate tax law 61

Our comments:

This was a new item that was added in Version 3.

The transfer loss and gain of cryptocurrency is stated as being recorded in the fiscal year of the contract date of the sale, etc.

However, in practice, the timing of the transfer of cryptocurrency and the contract date may be different.

If the transfer of cryptocurrency has not taken place and the payment has not been collected by the end of the fiscal year, it is expected to cause operational problems with only taxes being incurred.

Accounting should not only focus on the contract date, but also take into account the rights and obligations of the parties to the contract, and handle the transaction in a way that reflects the substance of the transaction.

The income recognition of transfer loss and gain of securities are also generally based on the contract date under tax law, but basing it off of delivery date is also allowed as an exception.

In our view, accounting and tax treatment that take into account the actual state of the transaction should be permitted.

3-1-2 Cost Basis of Transferred Crypto Asset

Question

Can you tell me about the transfer cost of crypto asset?

Answer

The transfer cost of crypto asset is calculated as follows:

Transfer cost = Book value per unit of crypto asset x Quantity of crypto asset transferred